Key Takeaways

- The Revenue Gap: While Steam hit a record $16.2 billion in 2025, the median revenue for new releases plummeted to just $249, with 66% of games earning less than $1,000.

- The Visibility Crisis: Over 19,000 games launched in 2025, but nearly half (47.5%) sold fewer than 100 copies, and thousands received zero user reviews.

- Genre Lock: Action titles and RPGs now control a staggering 75% of all platform revenue, leaving niche genres like visual novels fighting for scraps.

- The “Lipstick Effect”: Despite economic tightening, gamers are spending record amounts on discounted hits (like Detroit: Become Human), treating games as affordable luxuries.

- Hybrid Survival: The most successful studios are no longer relying solely on Steam; they are building Direct-to-Consumer (D2C) channels to capture higher margins and own their player data.

It’s 2026, and if you take a cursory glance at the headlines, the PC gaming industry looks like an unstoppable juggernaut. We are talking about numbers that would make a Wall Street banker blush. But if you sit down with an indie developer at a coffee shop—let’s say, over a slightly overpriced espresso—and ask them how 2025 went, you’ll likely see a very different picture. A picture of struggle, saturation, and a market that has become increasingly hostile to newcomers.

This is the Steam Paradox. On one hand, the platform is generating more money than ever before. On the other, the chances of a new game finding financial success have never been lower. It’s a classic case of volume vs. value, and understanding this dynamic is crucial for anyone trying to navigate the digital storefront today.

The “Gold Rush” is Over: Analyzing the $16 Billion Figure

Let’s start with the big number. According to reports from 80 Level, Steam generated an estimated(uploaded:Steam: $16B+ in 2025, Nearly Half of 19,000 Games Got Under 10 Reviews – 80 Level) in the first eleven months of 2025 alone. This figure smashed the previous year’s total of roughly $15 billion. December 2025 added fuel to the fire, generating a record-breaking $1.6 billion in gross revenue in a single month, driven by massive holiday sales.

On the surface, this suggests a healthy, booming ecosystem. But when you peel back the layers, the rot becomes visible. This revenue isn’t being spread peanut-butter-smooth across the thousands of developers on the platform. It is pooling at the very top.

The Median Reality Check

Data from Gamalytic paints a sobering portrait of the average developer’s reality. While the total revenue is up, the median revenue for games released in 2025 dropped to a shocking $249.

Let that sink in. $249.

That is the middle of the road. Half of the games released earned less than that. As noted in the Analysts Report, this is the second-lowest median revenue recorded in recent years, beat only by the abysmal $222 seen in 2024.

- Total released games: 19,000+

- Median Revenue: $249

- Average Revenue: $358,900 (skewed heavily by mega-hits)

The disparity is massive. A tiny percentage of hits like Call of Duty: Black Ops 7 or Monster Hunter Wilds are pulling the average up, while the vast majority of titles are essentially dead on arrival.

The Saturation Point: 19,000 Screaming Voices

The root cause of this disparity is volume. In 2025, Steam saw over 19,000 new releases, marking the highest annual total in the platform’s history. That averages out to roughly 55 new games every single day.

Imagine walking into a bookstore where 55 new books are shoved onto the shelves daily. How long does any single cover stay visible? Minutes? Seconds?

The “Under 10 Reviews” Club

Visibility is the currency of the digital age, and most games are bankrupt. According to SteamDB, almost half of all games released in 2025 received(uploaded:Steam: $16B+ in 2025, Nearly Half of 19,000 Games Got Under 10 Reviews – 80 Level).

- 2,200 titles received zero reviews.

- 7,100 titles peaked at nine or fewer.

- Only 6.2% of releases crossed the 500-review threshold (a common marker for “success”).

This isn’t just about bad games. It’s about invisible games. As the Analysts Report highlights,(uploaded:Analysts Report Drop in Game Revenue on Steam Despite Growing Number of Releases).

The Cost of Doing Business

Here is another brutal stat for you: 40% of games didn’t even recoup the $100 Steam publishing fee. Think about that. Four out of ten developers paid Valve for the privilege of hosting a game that didn’t earn enough to buy a nice dinner.

The Genre Wars: Action Takes It All

If you are an indie dev planning your next project, you might want to look at where the money is actually flowing. It turns out, the “long tail” of niche genres is thinner than we thought.

According to GameDiscoverCo, the revenue on Steam is heavily concentrated in specific genres. In fact,(uploaded:Analytics: Three-quarters of game revenue on Steam comes from action and RPGs).

| Genre | Share of Revenue | Top Subgenres |

| Action | 58.37% | Arena Shooters ($9.52B), FPS ($6.67B) |

| RPGs | 17.11% | Action RPGs ($3.89B), MMORPGs |

| Strategy | 13.97% | MOBA, RTS |

| Simulators | 9.76% | General Simulators, Job Sims |

| Sports | 1% | – |

If you’re making a Visual Novel or a Roguelike Deck Builder, the hill is steeper. These subgenres showed the lowest average revenue per game. The market is screaming for high-octane experiences—Arena Shooters and Battle Royales—though the barrier to entry there is astronomical due to the dominance of giants like Counter-Strike 2 and PUBG.

The “Lipstick Effect”: Why Gamers Are Still Spending

So, if the economy is shaky and inflation is biting, why did December 2025 see Steam generate 1.6 billion dollars in gross revenue, its highest-grossing month ever?

This phenomenon is often called the “Lipstick Effect”. When consumers can’t afford big-ticket items—like houses, new cars, or international vacations—they don’t stop spending entirely. Instead, they pivot to smaller, affordable luxuries that scratch the same emotional itch for a fraction of the price.

In a fascinating Reddit discussion on r/pcmasterrace, users broke this down perfectly. One user noted, “If you can’t upgrade hardware to play the newest games, might as well buy older games to never play on your current hardware.” Another pointed out that spending 60 dollars on a game for hundreds of hours of entertainment is still “pennies” compared to a 150 dollar night out at a restaurant, reinforcing games as high-value luxuries in a tight economy.

The Holiday Winners

The holiday sales chart for Dec 21, 2025 – Jan 5, 2026, proves this theory. It wasn’t just new hits selling; it was value.

- Arc Raiders: The big winner, shifting 1.2 million copies in two weeks thanks to a 20% discount.

- Detroit: Become Human: This older title moved 993,000 copies. Why? Because it was 90% off, priced at just $4.

- Battlefield 6: Despite mixed reception at launch, a 30% discount pushed 706,000 units.

Gamers are price-sensitive but willing to spend volume on “deals.” They are filling their backlogs because it feels like a safe financial decision in an unsafe economy.

Hardware as a Catalyst: The Steam Deck Factor

We can’t talk about Steam’s dominance without mentioning the hardware that put PC gaming into millions of backpacks. The Steam Deck continues to be a massive driver of engagement, turning more players into active Steam users on the go.

By 2025, the Steam Deck had sold an estimated 4 to 5.6 million units globally, according to aggregated analyst estimates. But more importantly, it’s driving playtime. In 2024 alone, concurrent playtime on the Deck surged to 330 million hours, a 64% increase year-over-year.

This hardware isn’t just a console; it’s a retention machine. It turns “dead time” (commutes, travel) into “Steam time,” extending engagement windows well beyond the traditional desk setup. For indie developers, this is a silver lining. Games that are “Deck Verified” often see a sales bump because they fit perfectly into this portable form factor and are clearly surfaced as a safe, optimized choice for handheld play.

The “Competition”: Why Epic Still Lags Behind

For years, the industry has looked to the Epic Games Store (EGS) as the challenger that would break Valve’s monopoly and perhaps offer developers a better lifeboat. In 2025, the verdict is in: Epic is growing, but it’s not catching up.

According to IconEra, while Epic has a massive 295 million registered users (thanks largely to Fortnite), its market share for third-party games remains stuck at around(uploaded:Epic Games Store vs Steam Market Share Statistics (2025) – IconEra).

- Steam Market Share: ~75%

- Steam MAU: 132 Million

- Epic Third-Party Revenue: $255 Million (down 18%!)

Epic’s 88/12 revenue split is objectively better for developers than Steam’s 70/30. But 88% of zero is still zero. Steam’s “monopoly” is maintained not by strong-arming developers, but by offering a superior service to customers—features like Workshop, seamless updates, and the Community Market keep players locked in.

The Survival Guide: Diversification is No Longer Optional

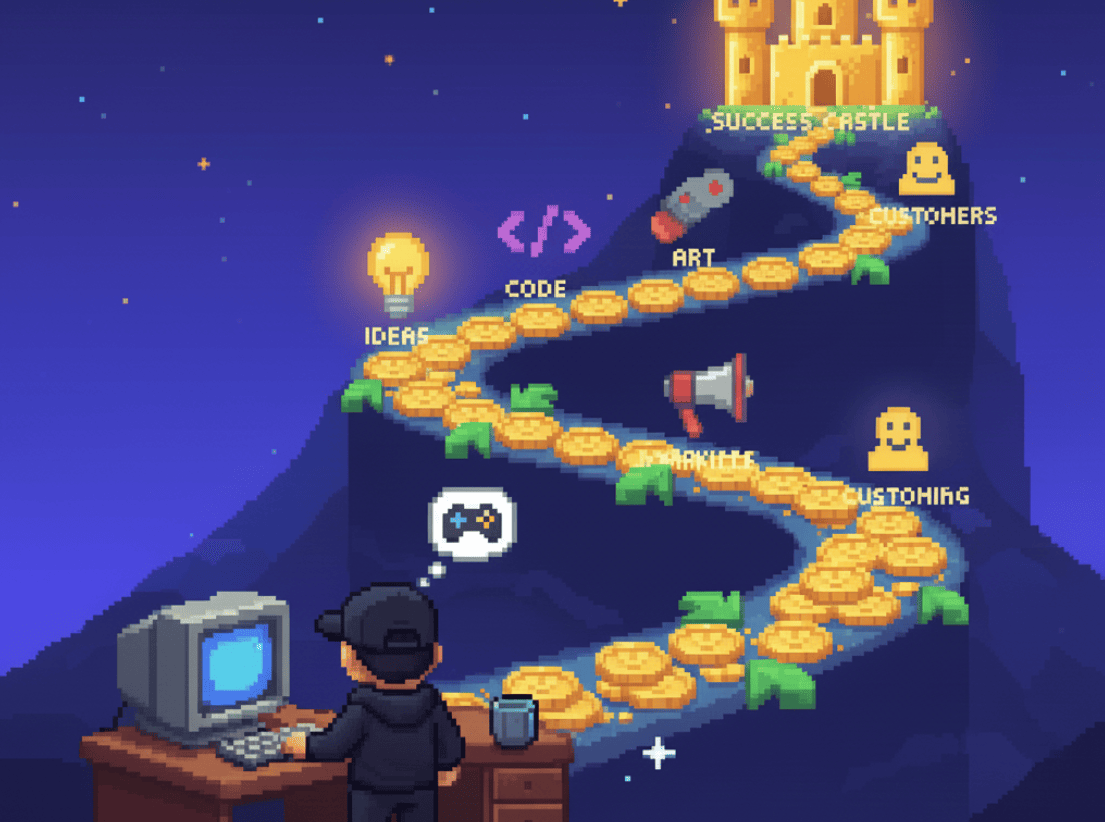

So, what is a developer to do? You can’t rely on Steam’s algorithm to save you. The most forward-thinking studios are taking matters into their own hands by building Hybrid Models.

Xsolla, a payment services company, argues that developers need to stop treating Steam as their only store and start treating it as their primary marketing channel.

The D2C Pivot

Selling Direct-to-Consumer (D2C) is becoming a critical strategy. By setting up a web store, developers can:

- Keep more revenue: Save that 30% platform cut (often keeping 95% of the sale).

- Own the data: When a user buys on Steam, they are Valve’s customer. When they buy on your site, they are your customer. You get their email. You can market your next game to them directly.

- Offer Bundles: You can sell “Founder’s Packs” or physical merch bundles that Steam doesn’t support easily.

A common myth is that Valve will ban you for selling keys elsewhere. This is false. As Xsolla clarifies,(uploaded:Diversify your PC revenue while staying fully Steam-compliant – Xsolla) as long as you maintain fair pricing. You can generate Steam keys and sell them on your own website.

“A hybrid model, where Steam provides scale and direct sales provide ownership, is rapidly becoming the future of PC publishing.”

Case Study: Techland

Techland used this strategy for Dying Light 2. They built a custom web store to sell pre-orders directly to players. The result? The web campaign generated(uploaded:Diversify your PC revenue while staying fully Steam-compliant – Xsolla). That might sound small, but for a AAA game, 6% of revenue with a significantly higher margin is millions of dollars.

Conclusion: Adapting to the New Normal

The paradox of 2025 is that PC gaming is bigger than ever — yet more difficult than ever. The days of “build it and they will come” are dead and buried.

Steam is no longer a curated storefront; it is an open ocean. And in this ocean, you have huge luxury liners (the AAAs) and millions of tiny rafts (the indies). To survive, you cannot just float and hope the current takes you to paradise. You need an engine.

That engine is community. It’s diversification. It’s understanding that while Steam is the place where people play your game, it shouldn’t be the only place where they pay for it.

As we look toward 2026, the developers who thrive won’t just be the ones making good games. They will be the ones who treat their studio like a business — building direct lines to their players and refusing to be just another statistic in the “under 10 reviews” column.

So, what’s your strategy? Are you putting all your eggs in Gabe Newell’s basket, or are you building your own safety net?

Join the Conversation

We want to hear from you. Are you an indie dev struggling with visibility? Or a gamer who spent way too much during the Holiday Sale? Leave a comment below or join our Discord to discuss the future of the platform. And if you found this analysis helpful, check out our deep dive into [The Rise of Handheld PCs in 2026].